is the interest i paid on my car loan tax deductible

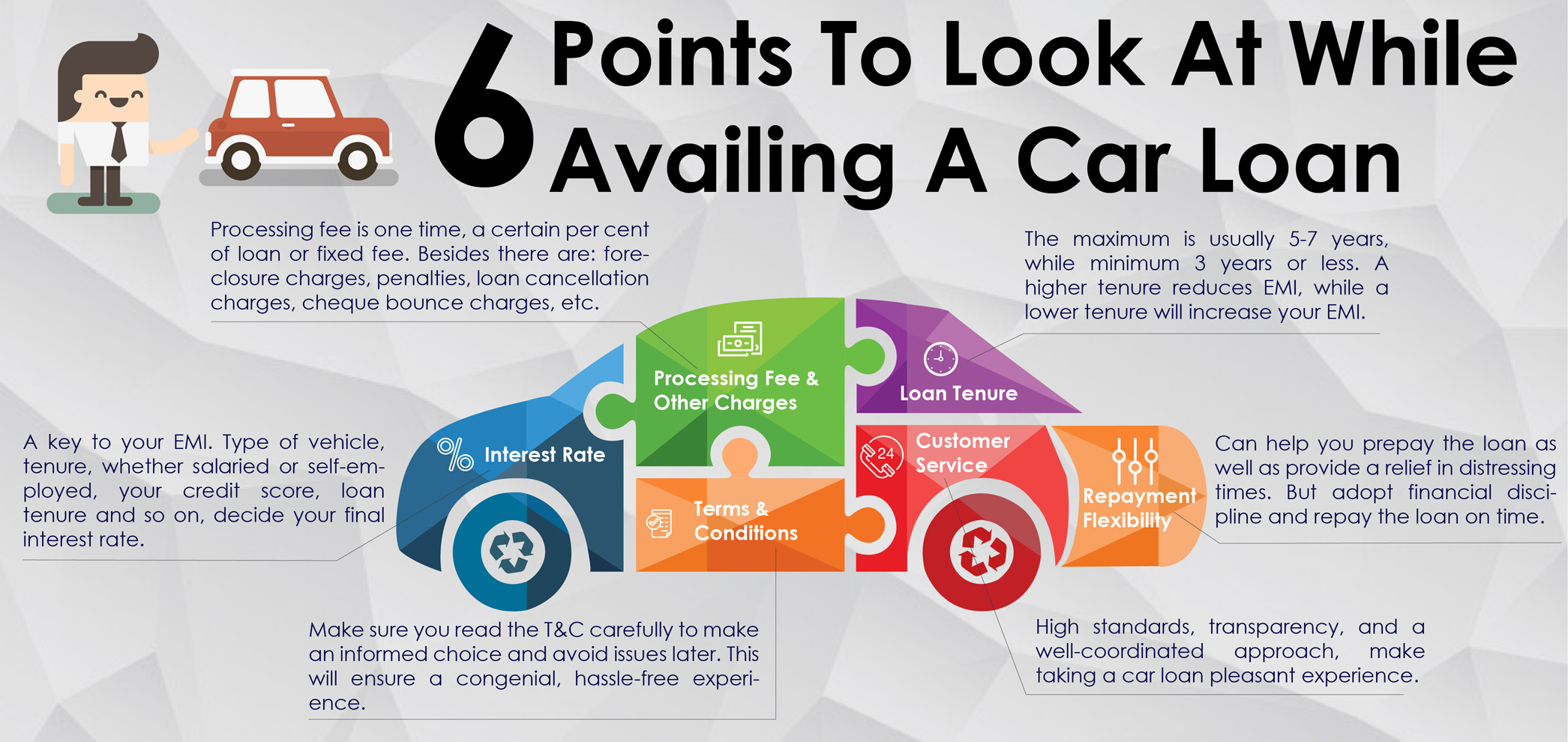

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Your deduction begins only when you spend the borrowed funds for business purposes.

Car Loan Tax Benefits And How To Claim It Icici Bank

Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions.

. Fees for other optional products or. Is there any tax benefit available on home loans. For interest paid on home loans for affordable housing an additional Rs15 lakh tax deduction under Section 80EE can be availed till 31 March 2022.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. Yes you can claim the amount paid towards the repayment of the principal and the interest components as deductions in your income tax return.

However the benefit would be lost if the. You get no business deduction for interest you pay on money that you keep in the bank. This is applicable for loans that were received till 31 March 2024.

In general you can deduct interest paid on money you borrow to invest although there are restrictions on how much you can deduct and which investments actually qualify you for the deduction. Credit card and installment interest incurred for personal expenses. His annual interest is deductible on his Schedule C Form 1040 because it is for a business loan.

The interest charged on up to 750000 of mortgage debt used to purchase a principal residence can be used as a deduction on taxes in the year that it is paid. So the EMI will also remain fixed. Interest paid on personal loans is not tax deductible.

Because interest on money. Money in the bank is considered an investment. The total income tax deduction that can be availed would now be up to Rs7 lakh for this.

You can deduct the interest expense once you start making payments on the new loan. Tax returns may be e-filed without applying for this loan. The mortgage interest deduction to homeowners is a very popular subsidy.

Because most of the monthly payments in the early years of a loan are interest this can really add up. Interest Paid Through a Second Loan. Among them is the deduction for investment interest expenses.

If approved funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund reducing the amount paid directly to you. A fixed rate of interest on a home loan means that the rate of interest does not change throughout the tenure of the loan. The federal tax code includes a number of incentives to encourage investment.

When you make a payment on the new loan you first apply the payment to interest and then to. Points if youre a seller service charges credit investigation fees and interest relating to tax-exempt income such as interest to. You cannot deduct interest you pay with funds borrowed from the original lender through a second loan an advance or any other arrangement similar to a loan.

Interest paid on a loan to purchase a car for personal use. What would my loan payments be. If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax.

He pays 6 interest on the loan. Home Loan Income Tax Benefits 2021.

This Time There Is Lots Of Auto Financing Options Available As Well As New Auto Loans Are One Of The Most Sufficient Optio Car Finance Car Loans Refinance Car

Can I Write Off My Car Payment

13 Factors That Affect Car Insurance Rates Car Insurance Car Insurance Rates Insurance

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Solved Where To Enter Car Loan Interest

Car Loans For Teens What You Need To Know Credit Karma

Is Buying A Car Tax Deductible In 2022

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

Explaining Car Loan Interest Rates Bad Credit Car Loan Car Loans Car Finance

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Business Tax Small Business Tax Business Tax Deductions

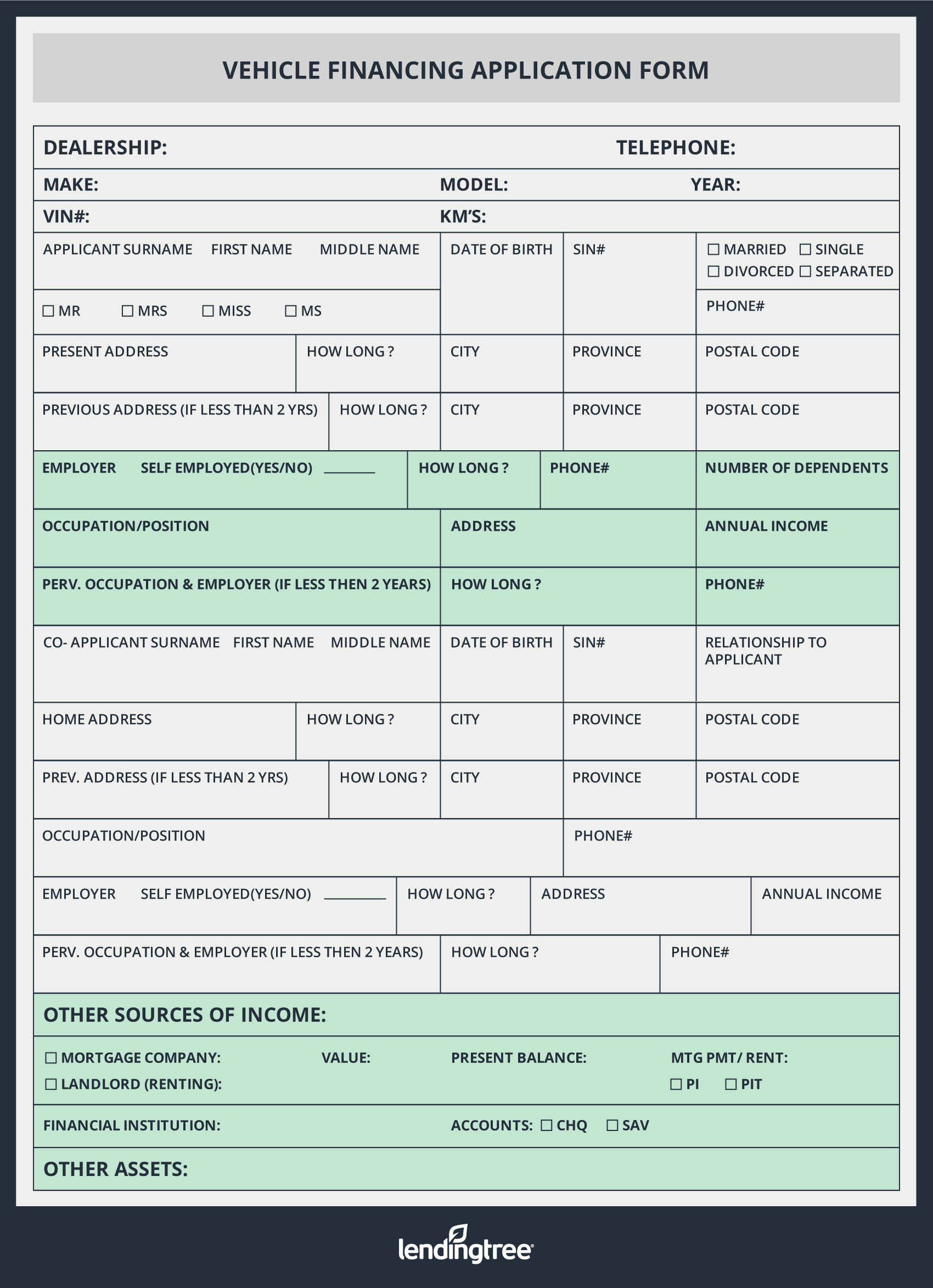

What Are Documents Required For Auto Financing Online Process Car Loans Car Finance Bad Credit

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Car Loan Tax Benefits On Car Loan How To Claim Youtube

The Amount Of Interest Paid Is Eligible For Deduction And Moreover There Is No Cap On The Amount To Be Deducted You Can Income Tax Saving Education Income Tax

Printable Car Loan Amortization Schedule Amortization Schedule Car Loans Schedule Template

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice