how much taxes are taken out of paycheck in michigan

Once you become jobless you can file a new claim or reopen an existing claim for benefits by calling special toll-free telephone number at 1-866-500-0017. Therefore if you owed 210 in taxes and you waited 60.

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

An additional 5 may be taken if youre more than 12 weeks in arrears.

. 2 Why Do I Owe State Taxes. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. The penalty maxes out at 25 of the taxes you owe.

For example you might complete your tax return and then realize that your total tax liability is 6000. Taxes for remote employees out of your state. Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022.

Because of this some basic calculation is required to figure out the wage amount used as a base for the benefit level. These are contributions that you make before any taxes are withheld from your paycheck. If your employee works from home in another state there are three things you need to do.

31 The Main Differences Between State and Federal Taxes. 21 Why We Have Pay State Income Tax. Before the official 2022 Kentucky income tax rates are released provisional 2022 tax rates are based on Kentuckys 2021 income tax brackets.

You can call and file by using a touch-tone telephone from anywhere in the USA or Canada. It can also be used to help fill steps 3 and 4 of a W-4 form. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The amount of federal taxes taken out depends on the information you provided on your W-4 form. If you have paid in 6500 through withholding over the course of the tax year youll receive a 500 tax refund. 32 Every State Has a Different Method of Calculating its Taxes.

If you arent supporting a spouse or child up to 60 of your earnings may be taken. Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your paycheck.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. This calculator is intended for use by US. The IRS will issue you a tax refund.

Look Out for Legal Changes. In this article youll find details on wage garnishment laws in Michigan with citations to statutes so you can learn more. While you might think taxes are boring its definitely worth learning the basics of tax optimization because it can not only save you money but it also gives you more money to invest.

In light of the recent COVID-19 pandemic many states have implemented temporary changes in unemployment eligibility and benefits to offset these increasingly difficult times. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for. The average American pays over 20 of their income to taxes so finding ways to save money on your taxes can really add up over time.

Since youll be withholding income taxes in your employees home state youll need to register with the state and possibly local tax agencies. If you receive a paycheck the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck. Instead unemployment recipients must request that taxes be withheld from their benefits and the withholding is limited to 10.

Florida paycheck laws have determined that all paychecks must be due for regular pay periods of no greater than one. Additionally IRS Notice 2020-65 allows employers to defer. 33 Is it Possible to Owe Taxes in More Than One State.

1 SoWhy Do I Owe State Taxes but Not Federal. Remember that whenever you start a new job or want to make changes youll need to fill out a new W-4. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

Withholding affects how much you will pay in taxes each pay period. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. One such factor would be the employment agreement between the employer and employee.

If you paid more tax than you owe either through withholding or estimated payments you have overpaid. When Must Paychecks Be Sent Out. Coronavirus Tax Relief for Self-Employed Individuals Paying Estimated Taxes.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. However if you dont file within 60 days of the April due date the minimum penalty is 210 or 100 of your unpaid tax whichever is less. In recent years the IRS has made multiple changes to the W-4.

Register with your employees state tax agency. Once again the timeline for when an employee is to receive their paycheck can vary due to several factors.

Mi Foc 10 52 2018 Complete Legal Document Online Us Legal Forms

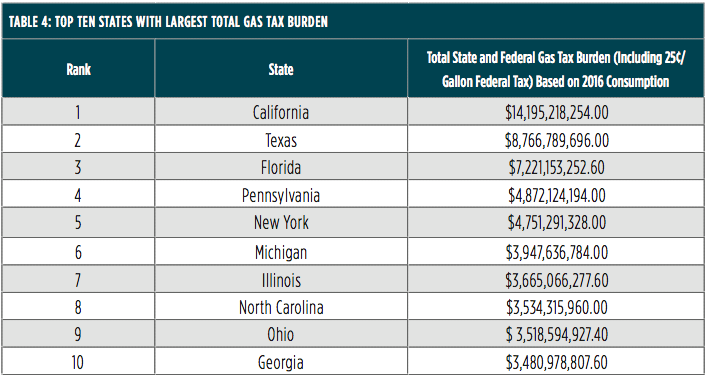

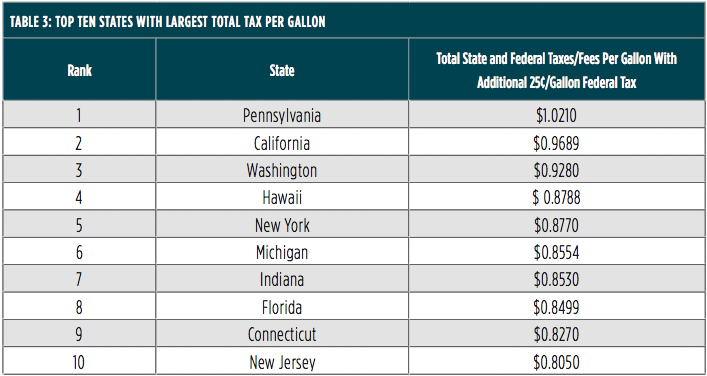

Every American Stands To Lose Under Unprecedented Gas Tax Increase

Property Asset Division Michigan Divorce Lawyers

Indiana Paycheck Calculator Smartasset

How Do You File Taxes If You Lived In Multiple States Community Tax

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis Paying Taxes Worker Workplace Accident

Affordable Tax Preparation Services In Westland Michigan Tax Avenger

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Indiana Paycheck Calculator Smartasset

The Ideal Amount To Withhold From Your Paycheck

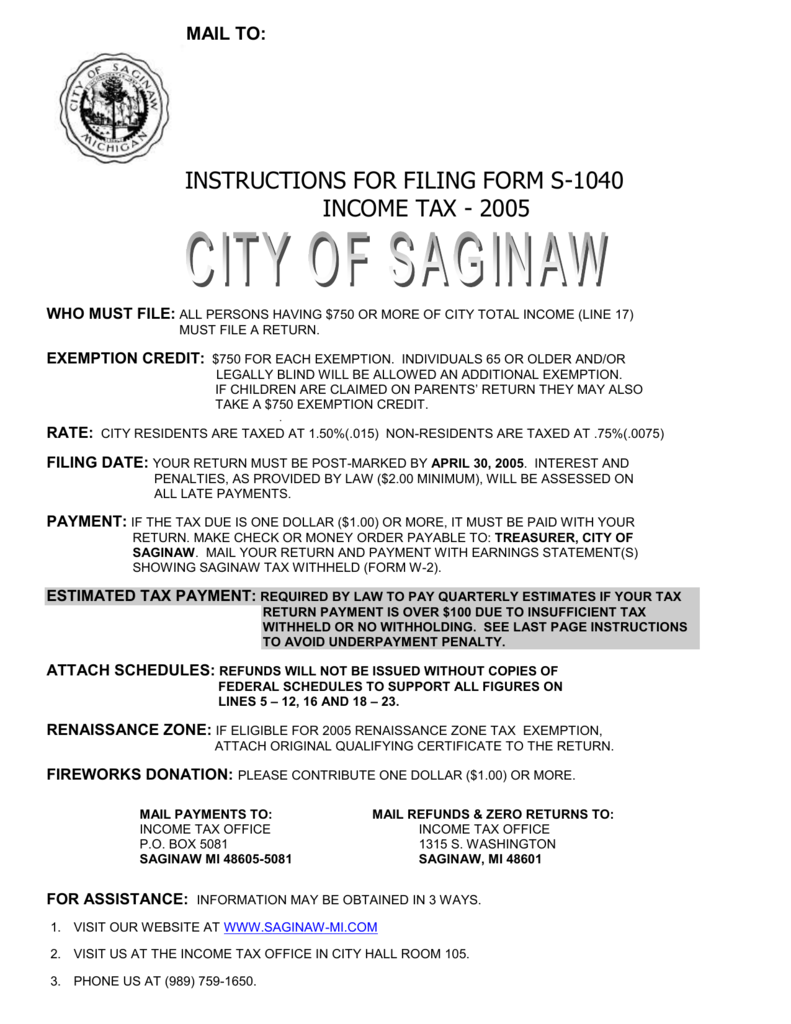

Instructions For Page 1 2005 S 1040

Every American Stands To Lose Under Unprecedented Gas Tax Increase

How To Start A Michigan Llc Shindelrock

Servcare Operations Analyst Salary In Detroit Mi Comparably